cross-posted from: https://lemmy.ml/post/2274037

Excerpts:

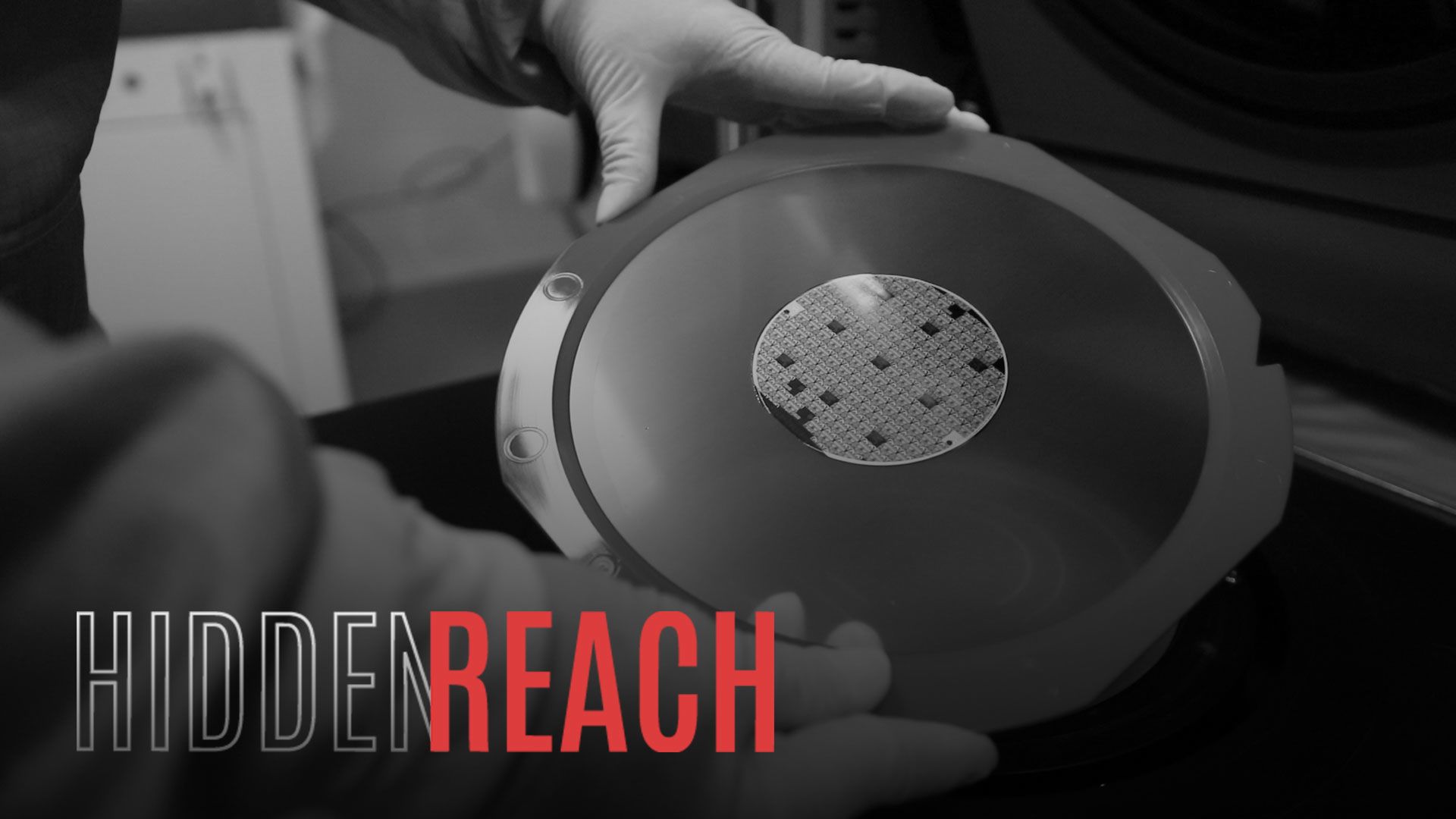

Decades of sweeping industrial policies have afforded China a near-total monopoly over gallium, a critical mineral used to produce high-performance microchips that power some of the United States’ most advanced military technologies. Recent moves by Beijing to restrict the export of gallium have laid bare the need for Washington and its allies to de-risk their critical mineral supply chains.

China produces a staggering 98 percent of the world’s supply of raw gallium.

Gallium is primarily extracted from smelting bauxite into aluminum, through which trace amounts of gallium can be recovered.

While bauxite is abundant, its mining is heavily concentrated in a handful of countries, and Chinese companies are responsible for nearly all gallium extracted from bauxite.

The United States and other advanced economies purchase gallium from China and refine it further for use in commercial and military applications.

A 2022 analysis by experts from the U.S. Geological Survey (USGS) found that a 30 percent supply disruption of gallium could have cascading effects that cause a roughly $600 billion decline in U.S. economic output, or 2.1 percent of GDP. […] The European Union and Japan have likewise identified gallium as a strategic raw material important for national security.

The Chinese government put this vulnerability on display in early July 2023 when it announced a slate of export restrictions on gallium metal and key gallium compounds (including GaN and GaAs) in response to recently implemented export controls on advanced chips and chipmaking equipment put in place by the United States, Japan, and the Netherlands. Within the first week of the announcement, gallium prices jumped 27 percent as global traders rushed to secure their supply.

Chinese companies, empowered by financial and political support from Beijing, have emerged as key players in the production of gallium-based chips. Innoscience, a leading Chinese manufacturer of gallium-based chips, operates two of the world’s largest GaN fabrication facilities and has expanded overseas with offices in the United States, Europe, and South Korea.

Losing ground to Chinese firms in the race for more capable and powerful compound semiconductors will put the United States on the back foot in developing next-generation technologies that will be crucial to military power and economic competitiveness. Beijing’s active role in creating a flourishing domestic ecosystem for gallium-based chips has already benefited China’s military development.

The fact that usable gallium is a byproduct of aluminum smelting combined with the political economy that is neoliberalism is pretty much a slow death by inflation for producing military radars. With only privatized actors from the resource extraction stage to the final stage of manufacturing, either the US pays exorbitant ransoms to Northrup-Grumman to keep the production line of AESA radars open or it wastes away and the US cannibalizes its stockpile of AESA radars when the captains of industry shift the use of gallium towards more reliable civilian production and contracts.